Ningbo Zhoushan Port announced a 10% increase in loading and unloading fees

- Share

- Issue Time

- Dec 3,2021

Summary

1.loading cost from ningbo will rise

2.shipping and container is busy

3.news from DNT Tools-automotive tool manufacuter

On December 1, Ningbo Zhoushan Port Co., Ltd. issued a public announcement on its official website. In order to further straighten out port charges, according to the "Port Charges and Billing Measures" of the Ministry of Transport and the National Development and Reform Commission (Jiaoshui Gui [2019] No. 2) , And the publication requirements of the Ningbo Port Charges Catalogue List. The adjustment is implemented on the basis of the original "Ningbo Zhoushan Port Foreign Trade Import and Export Container Port Charges Catalogue List". Public announcement, the list will be implemented from January 1, 2022.

In a word, the amount of information is huge, and the port circle (ID: gangkouquan) will take you to disassemble the relevant information behind the above announcement.

1. How much has the loading and unloading price increased?

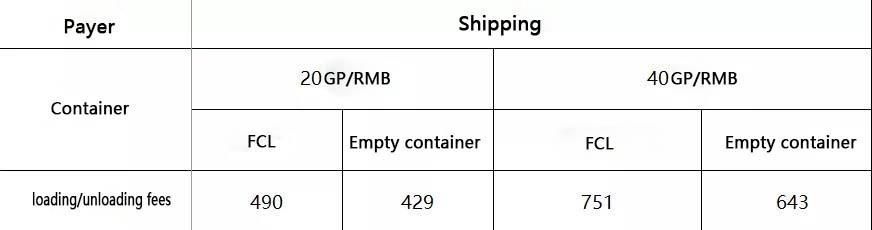

According to the list of charges published by Ningbo Zhoushan Port before, the charging standards for loading and unloading ships are as follows:

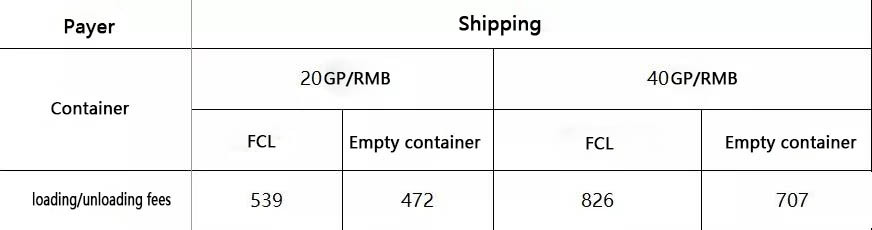

In other words, the adjustment of the port's charges for loading and unloading of 20-foot and 40-foot empty and heavy containers has achieved an increase of about 10%.

2. Does this fee increase need to be approved by the price regulatory authority?

According to Article 3 of Chapter 1 of the "Port Charges and Billing Measures" (2019), “Port charges include operating service charges that implement government pricing, government guidance prices, and market-adjusted prices. Among them, port charges that implement government pricing include cargo port services. Port facility security fees; the port fees that implement government-guided prices include pilotage (mooring) fees, tugboat fees, berthing fees, and oil boom use fees; port fees that implement market-adjusted prices include port operation leasing fees and warehouse yard use Fee, ship supply service fee, ship pollutant reception and treatment service fee, tally service fee".

The upward adjustment of ship loading and unloading operation fees at Ningbo Zhoushan Port is one of the types of port operation lump-sum fees, which belong to the category of market-adjusted prices. Port operators will independently formulate charging standards based on market supply and demand and competition, production and operation costs, and service content . No need to submit to the regulatory authority for approval.

3. Why does the port increase the loading and unloading fees?

First, the loading and unloading fees of Chinese ports are already at a relatively low level.

Chart: Comparison of container handling fees in major domestic and foreign ports.

Secondly, the increase in loading and unloading fees this time is the result of the interlocking forces of internal and external factors.

From the perspective of internal factors, the cost of terminal production and expansion has increased year by year. Specifically, first, the current strict reclamation control measures and environmental protection requirements have increased the construction and operating costs of the port; second, the price of labor, infrastructure, and raw materials has risen; It was an outbreak of the epidemic, and the cost of epidemic prevention suddenly increased. Port enterprises and employees have spent huge amounts of money, material and manpower in the epidemic prevention regulations and the special shift system. According to the understanding of the port circle, the epidemic prevention cost of a large foreign trade port in the south in 2021 alone will be as high as 500-700 million yuan. On the other hand, terminal loading and unloading rates have not risen but declined since 2018. This is not in line with the trend of sustainable development of the port in the future.

In terms of external factors, after 2021, shipping prices will continue to rise under the influence of multiple factors such as poor supply chains, congestion in the US West port, and congestion in the Suez Canal. It is expected that the shipping industry will achieve an amazing profit of US$150 billion in 2021. This wave of cyclical dividends in the industry has also spilled over to related markets such as freight forwarding, ship chartering, container leasing, and container building. All parties involved in the entire chain, except for ports, have made a lot of money.

As the previous analysis of the port circle, after the outbreak of the new crown epidemic, even if the final result of the shipping company is to profit from it, in the process, there are still intractable diseases such as port jump and drop in on-time rate. A handful of sugar is still mixed with glass. Scum. Foreign ports are even less resilient, and are directly "broken." There is no way before they can resume normal operations. Chinese ports have maintained an efficient level of loading and unloading under the same circumstances. If we hope that the entire supply chain will operate steadily in the face of sudden incidents and severe market fluctuations, it will be everyone's common choice for shipping companies to transfer part of the dividends and go hand in hand with the port.

4. Will other ports across the country follow up?

According to the understanding of the port circle, some ports across the country have been aware of the price increase of Ningbo Zhoushan Port, and the follow-up may follow up in due course.